# Delving into the Bored Ape NFT Phenomenon: Value Beyond Rarity

Written on

Chapter 1: Introduction to Bored Ape NFTs

The world of NFTs has taken off, particularly with the rise of the Bored Ape Yacht Club (BAYC). This franchise has seen astonishing success, with some NFTs selling for staggering amounts. Reflecting on my journey in the generative NFT space, I recall the moment the BAYC minted on April 23, 2021. Back then, NFTs were more of a curiosity than a serious investment, and I hesitated, having only about $500 in Ethereum. However, the narrative shifted dramatically when Beeple's artwork sold for $69 million, igniting my fascination with NFTs.

Fast forward, and the BAYC franchise has skyrocketed, with floor prices hitting 100+ ETH—an incredible milestone that illustrates its growing mainstream appeal. As of now, the floor price stands at 115 ETH, translating to over $289,000, with only a couple available at that price. With each sale, the floor price continues to rise, signaling robust demand.

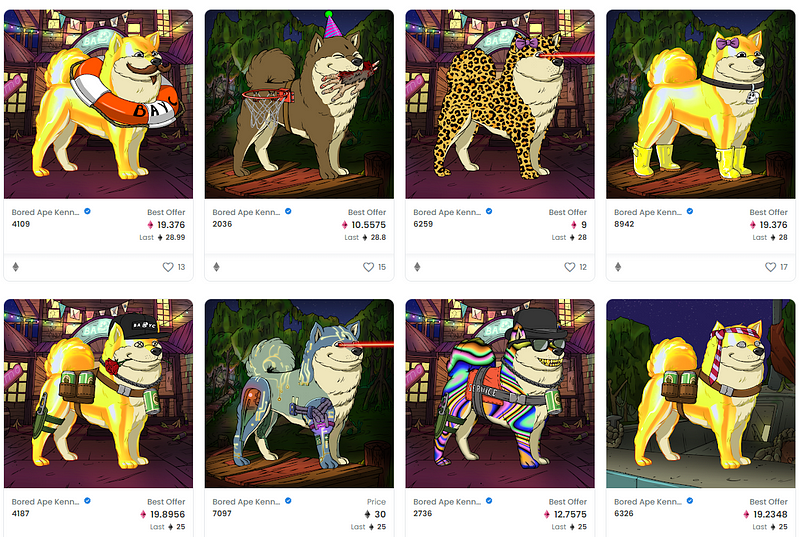

Chapter 2: Evaluating Investment in the BAKC

While many are eager to invest in BAYC or its sister collections, I want to specifically discuss the Bored Ape Kennel Club (BAKC). Recently, I invested in the BAKC after liquidating several NFTs, having accumulated a solid 10 ETH. As I examined my options, I realized that aesthetics play a pivotal role in the desirability of an NFT, often more than rarity itself.

Section 2.1: The Importance of Aesthetics

Many BAYC owners express their affection for their particular apes, emphasizing that aesthetics often outweigh rarity. In the NFT space, it's interesting to note that the most coveted traits may not always be the rarest. For instance, consider the preference for open versus closed eyes—personal taste can significantly influence value.

Investing in BAKC encourages buyers to evaluate traits based on long-term desirability. Questions arise about what features might attract future buyers. Is a dog with a clean face more appealing than one with a gory appearance? Such subjective preferences can greatly affect market trends.

Section 2.2: Branding in the BAKC

The BAYC brand has established itself as a luxury label, and this carries over to the BAKC. As the franchise grows, we can expect to see BAYC merchandise in major retail outlets, further enhancing its value. The presence of brand-related traits—such as the BAYC logo—can significantly influence an NFT’s market appeal.

Each BAKC NFT can represent a core aspect of the brand, and traits that display this branding could become increasingly valuable over time. Currently, NFT marketplaces offer limited opportunities for sellers to highlight such traits, but this may change as the market matures.

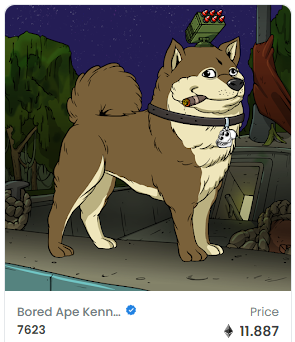

Chapter 3: Final Thoughts on Investing

In choosing my BAKC NFT, I focused on non-bloody, smiling dogs that showcased BAYC branding. I was fortunate to acquire NFT #4702, which I believe has strong long-term potential. The trading landscape is evolving, and investing in NFTs can feel akin to real estate transactions, leading to a more sophisticated marketplace.

As I look towards the future, I’m excited to see how the NFT ecosystem continues to develop. Perhaps your next NFT project could achieve the same recognition as the BAYC!

Explore the complexities of NFT traits and their investment potential in the video "Exploring the History of NFT Traits through Creative Data Visualization - Outer Lumen at NFT.NYC 2023." This presentation dives into the fascinating dynamics of NFT value and desirability.

Jim Dee is a dedicated writer and multimedia creator based in Portland. Discover more about his work and projects at JPD3.com. Thank you for reading!