Ethereum's Future: Can It Surpass Bitcoin Post-Merge?

Written on

Chapter 1: Current Landscape of Cryptocurrencies

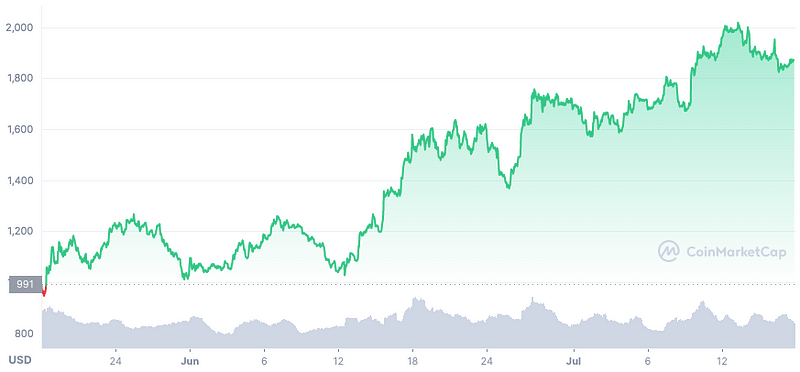

Ethereum currently ranks as the second-largest cryptocurrency, following Bitcoin. As the crypto community anticipates Ethereum's transition from proof of work to proof of stake set for mid-September, interest has surged. This "merge," a long-awaited event, appears to be finally taking place. Since the lows of June around $900, Ethereum (ETH) has experienced a remarkable rally of 100%, fueled by excitement surrounding the merge.

ETH has shown significant growth since its June 2022 lows, while Bitcoin maintains its position as the top cryptocurrency, boasting a market cap of approximately $450 billion. Ethereum ranks second with a market cap of around $230 billion. Historically, these two cryptocurrencies have dominated the market, with many Ethereum supporters eagerly awaiting the "flippening," a term used to describe the day Ethereum surpasses Bitcoin in market capitalization.

Market Capitalization Overview

Bitcoin: $450,000,000,000

Ethereum: $230,000,000,000

The Merge: A Milestone for Ethereum

The transition to proof of stake represents a critical development for Ethereum, aiming to cut energy consumption by an impressive 99.95% according to the Ethereum foundation. This shift also paves the way for future scalability upgrades, such as sharding. Regardless of differing opinions on Ethereum's evolution, the merge is imminent, and its implications for the broader cryptocurrency market are worth discussing.

Like this post? Sign up for my newsletter!

ETH 2.0 and Implications for GPU Mining

What You Need to Know

Pre-Merge Sentiment

As mentioned, Ethereum's trading sentiment appears optimistic heading into the merge. Traders seem to be "buying the rumors," but it remains uncertain if they will "sell the news" once the transition to proof of stake is completed. In the short term, Ethereum's outlook appears positive.

Simultaneously, Bitcoin is also recovering from its June lows, experiencing upward consolidation from around $18,000. Currently, Bitcoin seems to have found support near $20,000 but has yet to break above the mid-$20,000 range to reach the desired levels of $28,000-$30,000 that bulls are hoping for.

During the Merge

As September approaches, the Ethereum merge is anticipated. If everything proceeds smoothly, it should be seen as a favorable development for Ethereum. However, there is a chance that short-term traders might sell on good news, resulting in a price correction later in the month.

If complications arise during the merge or if exchanges face challenges dealing with ETH and ETH2, we may see a decrease in price.

Post-Merge Outlook

In the long run, the merge is expected to positively influence the Ethereum network. Long-term investors are likely to witness favorable price appreciation and will probably remain steadfast in their investments. Many prominent exchanges already support ETH2 staking, and numerous investors have been holding or staking their ETH for an extended period and will likely continue this behavior after the merge.

Bitcoin vs. Ethereum

Is the flippening a possibility? If it were ever feasible, the merge is unlikely to be the sole catalyst for such an event. While Ethereum may achieve its goals, it operates on a different blockchain than Bitcoin, serving distinct purposes.

Historically, altcoins have outperformed Bitcoin during bull markets; however, when corrections occur, investors often gravitate back to Bitcoin as a safer option. The merge could reflect this trend, where ETH might temporarily outperform BTC but would need to double its market capitalization while Bitcoin remains stable for a flippening to occur.

Like this post? Sign up for my newsletter!

Key Bitcoin Price Levels to Monitor in 2022

Understanding Critical Price Points in the Current Bitcoin Market Cycle

Challenges of Surpassing Bitcoin

Flipping Bitcoin currently seems an unlikely scenario, especially considering its increasing global adoption. While advancements in Ethereum and other networks may chip away at Bitcoin's market dominance, they would still need Bitcoin to face substantial setbacks for a flippening to become plausible.

Conclusion

The impending Ethereum merge is poised to be a highly beneficial occurrence for ETH holders and the Ethereum ecosystem. However, for ETH to surpass BTC, it would require more than just a bullish trend surrounding one event.

Bitcoin's market dominance, currently around 40%, reflects its ongoing significance in the cryptocurrency space, despite competition from other cryptocurrencies like Ethereum. As the crypto landscape continues to evolve, Bitcoin appears well-positioned to maintain its leading role.

I personally hold both Bitcoin and Ethereum. I began with Bitcoin but later discovered Ethereum and have mined it at home. I would appreciate any bullish sentiment surrounding Ethereum post-merge, but I also recognize Bitcoin's consistent growth, establishing higher highs and lower lows year after year as its network expands. In terms of total market capitalization, Bitcoin continues to be the frontrunner.

I Built an Ethereum Mining Rig in 2020 for Under $1,000

How to mine Ethereum.

Thanks for reading! I am not an investment or financial advisor; this is not financial advice. All opinions expressed are solely mine. For more content like this, consider subscribing to my weekly email.

Chapter 2: The Merge and Its Implications

The first video, "How Ethereum can flip Bitcoin after The Merge!" examines the factors influencing Ethereum's potential to surpass Bitcoin, particularly following the merge and its implications for both cryptocurrencies.

The second video, "Ethereum Is Dying (Sad)" discusses the challenges and criticisms facing Ethereum amidst the ongoing developments in the cryptocurrency market.