<Exploring Solana's Surge: Insights for Crypto Investors to Consider>

Written on

I have some significant regrets in the crypto space.

Looking back, I wish I had invested more in Ethereum during 2018 or accumulated a larger stake in a promising asset that ultimately soared.

During the ICO boom and subsequent bust, many fled the market as if escaping a disaster. Ethereum was priced at $80, and the media ridiculed those venturing into these mysterious tokens, branding it as a passing fad.

Fast forward to the present; following the approval of Ethereum ETFs just four months after Bitcoin's ETF launch—the most successful in history with $50 billion in net inflows—it's evident that the marketing for these financial products has yet to fully impact the market.

The figures for Bitcoin ETFs represent over 10% of Ethereum’s market capitalization. What makes the discussion intriguing is that more than 23% of Ethereum is currently staked, rendering it unavailable for purchase.

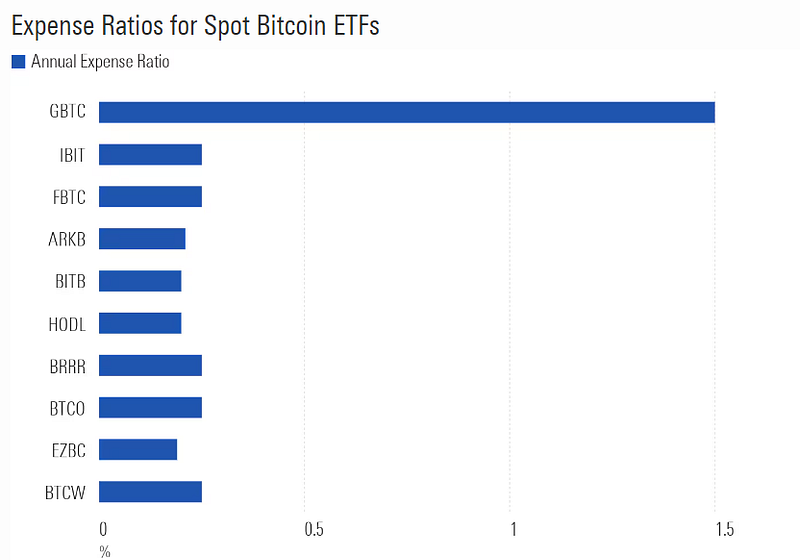

With staking rewards at 3.18%, money managers have an incentive to push these products, especially considering ETF fees range from 0.20% to Grayscale's 1.5%.

If these profit-driven Wall Street investors can secure staking rewards, it’s likely that they will aggressively market it to the public.

Investors will compete for these assets, but as renowned macro investor Raoul Pal wisely notes, “Remember, don’t use leverage, don’t FOMO, and just buy the top three assets.”

He’s absolutely correct.

However, my current investment focus is not on Bitcoin or Ethereum. This isn’t due to a lack of faith in them; rather, I find Solana more appealing due to its earlier adoption phase and a smaller market capitalization of $80 billion.

This viewpoint often triggers defensiveness among others, but crypto expert Ivan aptly puts it, “It’s because you’ve married your bags—never do that.”

I used to become overly emotionally attached to a single coin, blinding me to other potentially better opportunities, all while surrounded by a community echoing the same sentiments.

Removing emotion from the equation and applying straightforward math reveals the following: Solana's market cap stands at $80 billion, while Ethereum's is $450 billion and Bitcoin’s is $1.3 trillion. For one to double their investment, these market caps must also double.

Though it may seem simplistic, often the simplest explanations yield the most accurate outcomes. Doubling $80 billion requires much less buying pressure.

Especially during bull markets, as all assets tend to rise; hence, the idea of diversification in crypto is outdated and traditional portfolio theory lacks relevance.

Established smaller-cap cryptocurrencies will likely outperform, and Solana appears poised to be the next in line.

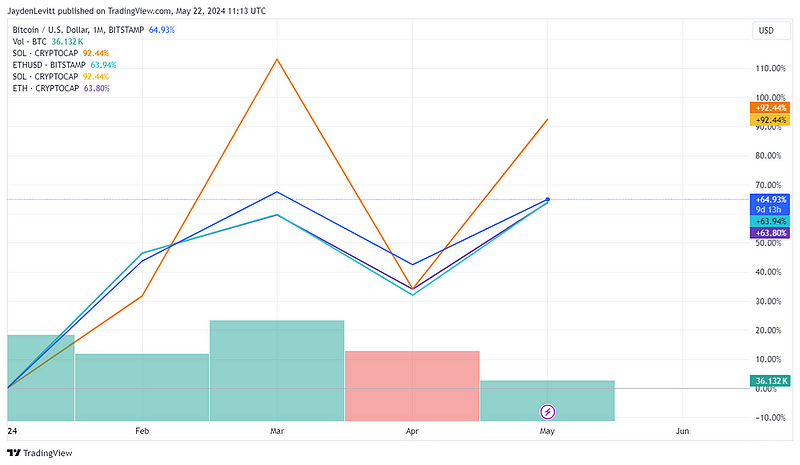

This year, Solana has risen 92% (600% from its lows), while Ethereum and Bitcoin have increased by 64% and 63%, respectively. The orange line in the charts represents Solana.

Solana Captures Investor Interest This Cycle

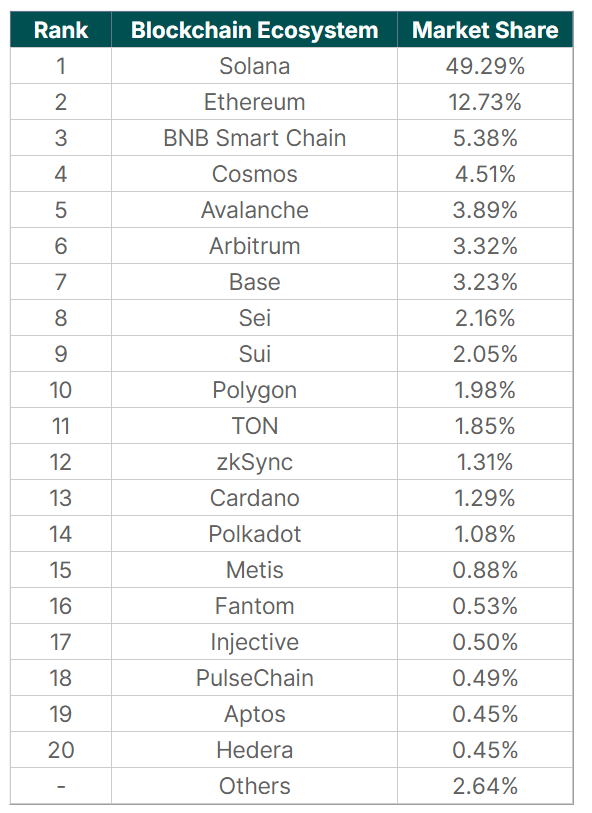

A recent study by CoinGecko analyzing global web search trends from January 2024 to the present reveals significant insights into blockchain ecosystems.

The findings are remarkable.

Among 58 blockchain ecosystems, Solana leads with 49.29% in investor interest, which is unsurprising given its rapid transaction speed, low fees, and the fact that most of the 1,300 listed meme coins are built on its platform.

My experience with Ethereum in 2018 taught me a crucial lesson: never assess a technology's performance solely based on price. This is a common pitfall.

While many were preoccupied with a 70% price drop, around 4,751 active developers continued to dedicate their efforts to advancing the technology.

During moments of doubt, I ask myself, “Are we becoming more digital or less?”

The answer is undoubtedly more, prompting me to invest further, as price fluctuations are merely background noise, especially for the top three established assets.

In this cycle, there is only one winner: Solana is making significant strides.

> Solana's 24-hour trading volume hit $1.262 billion, surpassing Ethereum’s $1.167 billion.

> In the same timeframe, Solana’s 7-day NFT sales volume reached $99.3 million, outpacing Ethereum’s $82.4 million.

> Solana recorded 723,000 daily active addresses, significantly more than Ethereum's 374,000.

> Additionally, Solana completed 25.9 million daily transactions, while Ethereum managed just 1.15 million.

The Shift is Apparent

I used to ponder, “What if a recession hits? How will it affect prices?”

The truth is, no one can predict this, but the crypto market tends to price in future events about 6–9 months ahead.

Crypto markets anticipate potential future liquidity; with the Federal Reserve hinting at three possible rate cuts in 2024, this suggests more stimulus is on the horizon.

These rate cuts are just one aspect of a broader narrative.

- The U.S. debt-to-GDP ratio sits at 121%, necessitating money printing to manage existing debt as borrowing outpaces productivity.

- Basel Four regulations will come into effect in 2025, requiring banks globally to hold substantially higher reserves before lending (increasing from 2.5% to 10%).

- The Bitcoin halving event has occurred, curtailing the supply of the leading digital asset.

- It’s an election year, with every sitting president historically increasing stimulus as a lure for votes.

When the money printer is activated, it accelerates asset prices.

Global macro investor Raoul Pal anticipates that Solana will outperform both Ethereum and Bitcoin, citing its similar stage of network adoption and the growing narrative of “everything on Solana.”

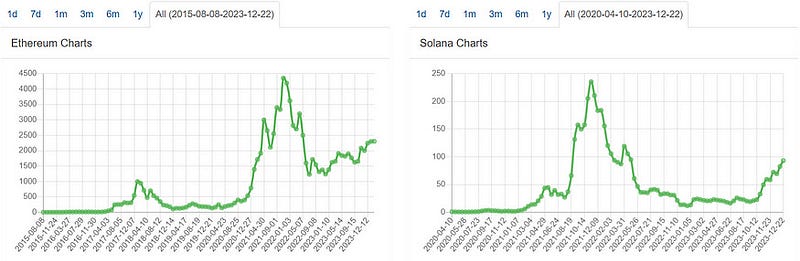

Solana is essentially one cycle behind Ethereum.

> Raoul Pal — Source

> “I just compared the chart of Ethereum in 2018 to Solana’s chart. They are nearly identical. Ethereum increased 47 times from its low, and Solana dropped to $8. The current price is ‘well wrong.’”

Considering Solana’s impressive data compared to Ethereum, it’s easy to see why Raoul makes a compelling case.

When evaluating Solana’s dramatic price increase, it mirrors Ethereum's significant surge in 2017. This comparison becomes fascinating.

They appear to be reflections of one another.

Concluding Thoughts

My journey with Solana began at Veecon in Minnesota, a major WEB3 conference in 2022.

Anatoly Yakovenko, a former Dropbox engineer and the founder of Solana, shared the stage, discussing his vision for the platform, which he named after a beach he once surfed at.

What stood out was his focus on consumer-friendly applications rather than just the technical aspects, unlike Ethereum proponents who often emphasize scalability challenges like sharding and layer two solutions.

His goal is to position Solana as the go-to Blockchain for the masses, though its success remains to be seen.

Data indicates a technological edge for Solana over Ethereum, boasting a transaction capability of 750,000 per second compared to Ethereum’s 30 and Bitcoin’s 5.

Solana has also introduced an innovative upgrade called “Firedancer,” with the potential to scale up to one million transactions per second. This speed surpasses every existing financial system.

For context, Visa processes 24,000 transactions per second, allowing for the minting of one million NFTs on Solana for approximately $100, which has fueled the meme coin frenzy due to minimal friction.

Enhancing speed and reducing costs unlocks numerous use cases, such as using NFTs for receipts or ticketing—applications that are impractical at scale on Ethereum due to high gas fees.

While I remain optimistic about Bitcoin and Ethereum, I believe Solana will outperform them this cycle due to its growing network adoption and newer platform.

Consider this: if a network starts with one user and gains another, that’s a 100% increase. Conversely, if a network already has 50 users and gains one more, that’s merely a 2% increase.

Solana is closely tracking Ethereum but is currently one cycle behind. Ethereum surpassed a market cap of $500 billion in the last cycle.

If Solana follows suit in this cycle, it could reach a price of around $1,200 per SOL, marking a sevenfold increase from its current valuation.

This is an opportunity worthy of attention.

Want to be notified whenever I publish a new article? Join over 2,000 subscribers here. It’s free, and you can unsubscribe anytime!

This article is intended for informational purposes only and should not be construed as financial, tax, or legal advice. Please consult a financial professional before making any significant financial decisions.