Exploring the Bitcoin Phenomenon: A Deep Dive

Written on

Chapter 1: Understanding Bitcoin's Intricacies

The Enigma of Bitcoin

When first encountered, Bitcoin might seem straightforward. Brandon Quittem aptly describes this journey: “I compare the quest to grasp Bitcoin to a mountain climber who repeatedly encounters ‘false peaks’ that mislead them into thinking they’ve reached the summit.” However, true comprehension involves recognizing the vastness of what remains unknown.

What Constitutes Money?

This deceptively simple inquiry is the gateway to understanding Bitcoin. Many individuals take our financial systems for granted, believing in the strength of the US economy and the unwavering nature of the dollar. After all, isn’t the government always looking out for its citizens?

Bitcoin initially attracted libertarians, gold enthusiasts, and tech aficionados due to the skepticism required to challenge the existing systems. The US dollar has dominated the monetary landscape for a century, primarily due to the lack of genuine competition—until Bitcoin emerged.

Bitcoin: A Superior Form of Currency

Delving into the details of why Bitcoin stands out could fill an entire volume, but this discussion will remain concise. Simply put, Bitcoin surpasses fiat currencies.

Fiat money, which includes the US dollar, the Chinese yuan, and the euro, is government-issued and subject to their control. This means governments can print unlimited amounts of money. In contrast, Bitcoin operates independently of governmental authority, existing as a decentralized ledger that cannot be manipulated for the benefit of any single entity. The supply of Bitcoin is capped at 21 million, preventing any further inflation.

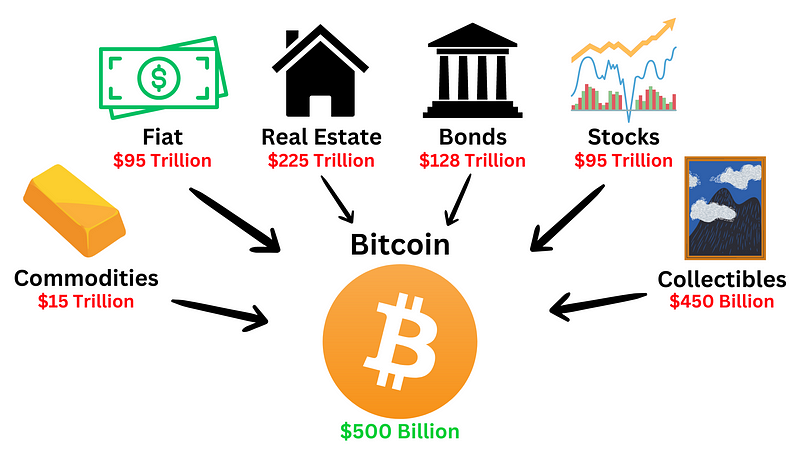

The Bitcoin Black Hole

Bitcoin is poised not only to draw value from fiat currencies but also to siphon off value from various asset classes. It is not just a better currency; it is also superior to many other investments. As more individuals explore the depths of Bitcoin, monetary energy will increasingly flow towards it.

Evaluating Other Asset Classes

While a thorough analysis is beyond this article's scope, here’s a quick overview of how Bitcoin compares to other asset types:

- Commodities: With rising prices, supply increases. In contrast, Bitcoin's supply is fixed.

- Fiat Currencies: Subject to government control and inflation, leading to potential devaluation.

- Real Estate: While it may be a strong asset aside from Bitcoin, it faces bubbles and lacks portability.

- Bonds: Often viewed as government-backed Ponzi schemes.

- Stocks: Heavily reliant on company performance and the underlying fiat economy.

- Collectibles: Their value is dependent on trends, and supply continues to increase.

Bitcoin as the Monetary Black Hole

As illustrated, Bitcoin is already absorbing monetary energy from various asset classes, with significant potential for growth. While future predictions are uncertain, exploring the possibilities is intriguing. In 2023, total assets are valued at approximately $550 trillion, while Bitcoin's market cap is merely $500 billion. This equates to roughly 0.1% of all assets.

If Bitcoin captures just 1% of global monetary energy, its value could increase tenfold. At 5%, that’s a fiftyfold increase. A 10% share could mean a hundredfold rise. This analysis does not consider the rising supply of other assets. Even if Bitcoin maintains its 0.1% share, inflation will likely drive its US dollar value higher.

The Crazy Bitcoin Black Hole explores how Bitcoin is reshaping the financial landscape, drawing parallels to a black hole's gravitational pull.

Bitcoin is a Black Hole with Harry Sudock delves into the implications of Bitcoin's dominance and its effects on the broader economy.

Want to support my writing? Use my referral link!

By becoming a member, you gain access to my articles and thousands of others, helping to support my work.