<The Rise of Decentralized Finance: A Shift in Economic Paradigms>

Written on

Decentralized finance (DeFi) is poised to overhaul the traditional centralized financial system. The existing global financial framework has generated substantial wealth for those with resources and access to financial institutions. However, crises like the 2008 housing collapse have diminished public trust in this system, affecting both the wealthy and everyday individuals.

Before these crises, alternatives to the unstable centralized financial framework were limited. Yet, the past decade has witnessed the rise of a decentralized financial model fueled by technological advancements and a pressing need for inclusivity for underprivileged populations.

Technological Innovations

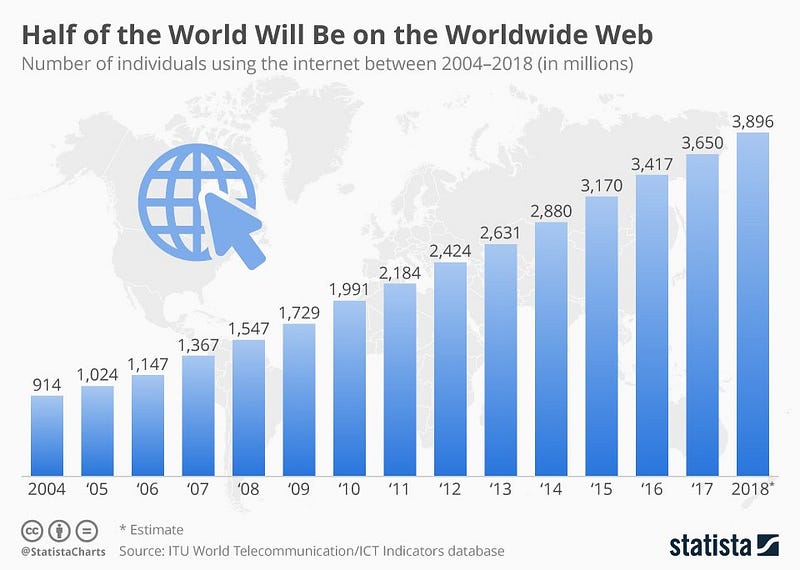

- Internet (Early 1990s): Initially a research initiative (ARPANET) in 1969, the Internet has evolved into a global communication platform. By 2018, nearly 4 billion individuals (around 51% of the global population) had Internet access, and this number continues to rise.

- Smartphones (2007): The advent of smartphones in the early 21st century transformed communication and daily living. The World Bank reports that two-thirds of the approximately 1.7 billion unbanked individuals globally possess smartphones, enabling them to participate in the emerging financial landscape.

- Digital Banking (1994): The rise of the Internet led to increased comfort with online financial transactions. Traditional banks have adapted by offering digital banking services, which have expanded to cover a wide range of offerings. By 2018, the number of digital banking users reached 2 billion, according to Juniper Research.

- Digital Ledger Technology (2008): DLT and associated cryptocurrencies, such as Bitcoin, have been pivotal in facilitating this shift. Public blockchains are based on the principle of decentralization, which will be elaborated on later.

- Fintechs (1998): The integration of DLT into finance has given rise to fintech companies, which have revolutionized the financial industry in recent years. These firms cater to the tech-savvy preferences of Millennials and Generation Z.

Public Blockchains vs. Centralized Systems

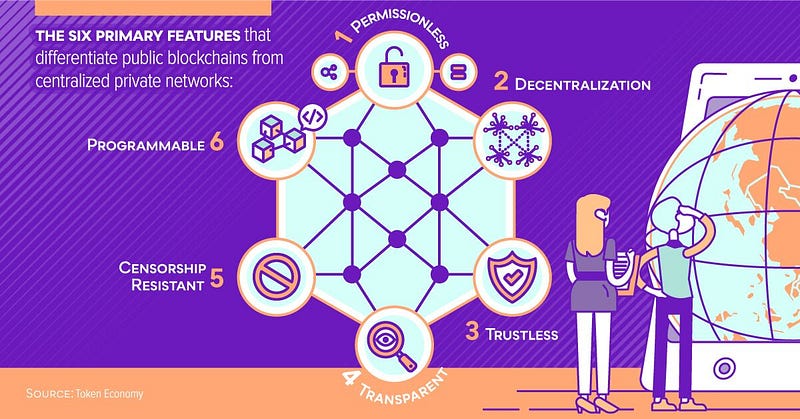

Let’s explore features of decentralized networks that make them attractive for the new financial model:

- Decentralization: Data is stored across numerous computers (nodes) worldwide instead of relying on a single server, reducing susceptibility to attacks.

- Permissionless Access: Anyone can join the network, regardless of wealth or location, unlike traditional financial systems that impose barriers based on socioeconomic status.

- Trustlessness: The network operates without the need for a central authority to validate transactions. This differs from the current financial system, where transactions are overseen by banks and governments, which are often viewed with skepticism.

- Transparency: Transactions on public blockchains are visible and easily verifiable, promoting accountability. In contrast, centralized financial systems typically lack transparency.

- Censorship Resistance: No single party can reverse transactions or shut down the network, unlike centralized systems where governments can exert control.

- Programmability: Developers can incorporate business logic into cost-effective, interoperable financial services, streamlining processes that are often cumbersome in traditional systems.

Effects of Decentralized Finance

- The most significant impact will be inclusiveness, expanding access to financial services globally. Fintechs are essential in this transition, allowing anyone with an Internet connection or smartphone to engage with financial systems, leveling the playing field between affluent individuals and those in remote areas.

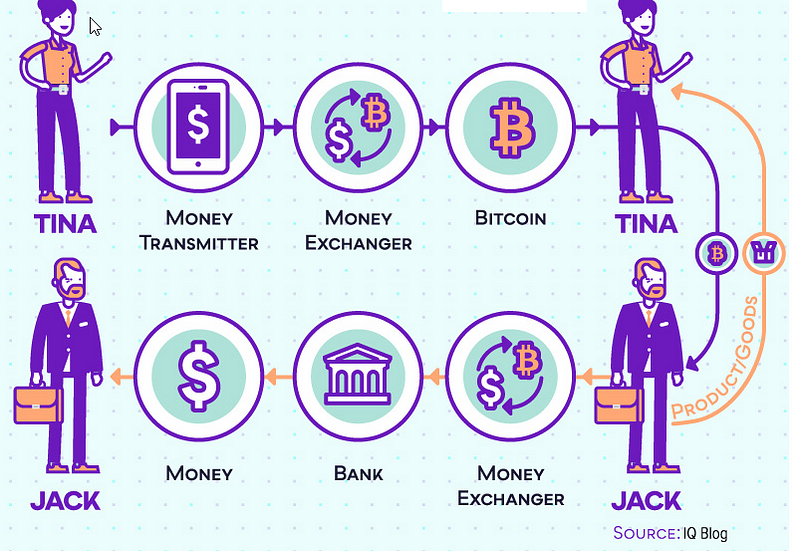

- Elimination of Intermediaries will reduce costs significantly, especially for remittance services. Currently, the average global remittance fee is around 7%, exceeding the G-20 target of 5% and the UN goal of 3%. Services like Xoom, TransferWise, and WorldRemit are already making remittances cheaper and faster.

- Improved Privacy and Security of consumer data is another key benefit. Decentralized finance allows for secure transactions without a central authority, minimizing the risk of data breaches that plague centralized systems.

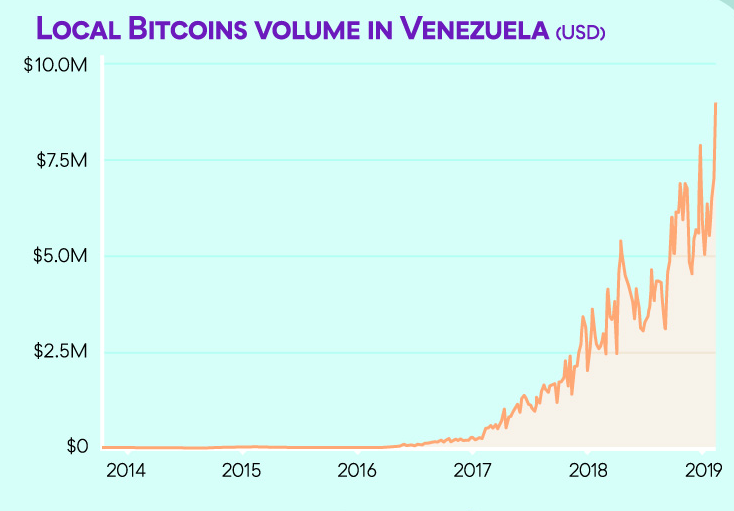

- The immutability of decentralized networks helps protect users from governmental financial censorship. In countries with authoritarian regimes, individuals can safeguard their wealth using decentralized systems, as seen in Venezuela, where hyperinflation has led citizens to rely on cryptocurrencies like Bitcoin and Dash.

- The simplicity of decentralized financial services enhances user experience. Applications enable intuitive use without the complexities characteristic of traditional systems, allowing for seamless international transactions across borders.

Although the transition is underway, it remains a lengthy journey. A sudden disappearance of governments and central banks is unlikely, suggesting a gradual evolution from centralized to decentralized finance. Ideally, a hybrid system might emerge, where public blockchains coexist alongside traditional financial institutions, allowing users to manage their economic activities across both platforms. This could provide investors with opportunities to diversify their portfolios and mitigate systemic risks.

Email? | Twitter? | LinkedIn? | StockTwits? | Telegram?

Recent Articles:

- Why Inclusive Wealth Index is a better measure of societal progress than GDP?

- What do you know about Smart Credentials, J-Coin & c-lightning?

- Lightning torch initiative — spreading the word about scalable bitcoin micro payments.

- The unbundling & rebundling of the Fintechs.

Originally published at www.datadriveninvestor.com on March 14, 2019.